Service Details

Industry Types

- Healthcare

- Hospitality

- Transportation

- Media, Telecom and Entertainment

- Energy and Utilities

- Consumer and Retail

- E-Commerce

- Food and Beverage

Payment Solutions

- Connectivity

Solution availability

- NAMR

- APAC

- EMEA

- LATAM

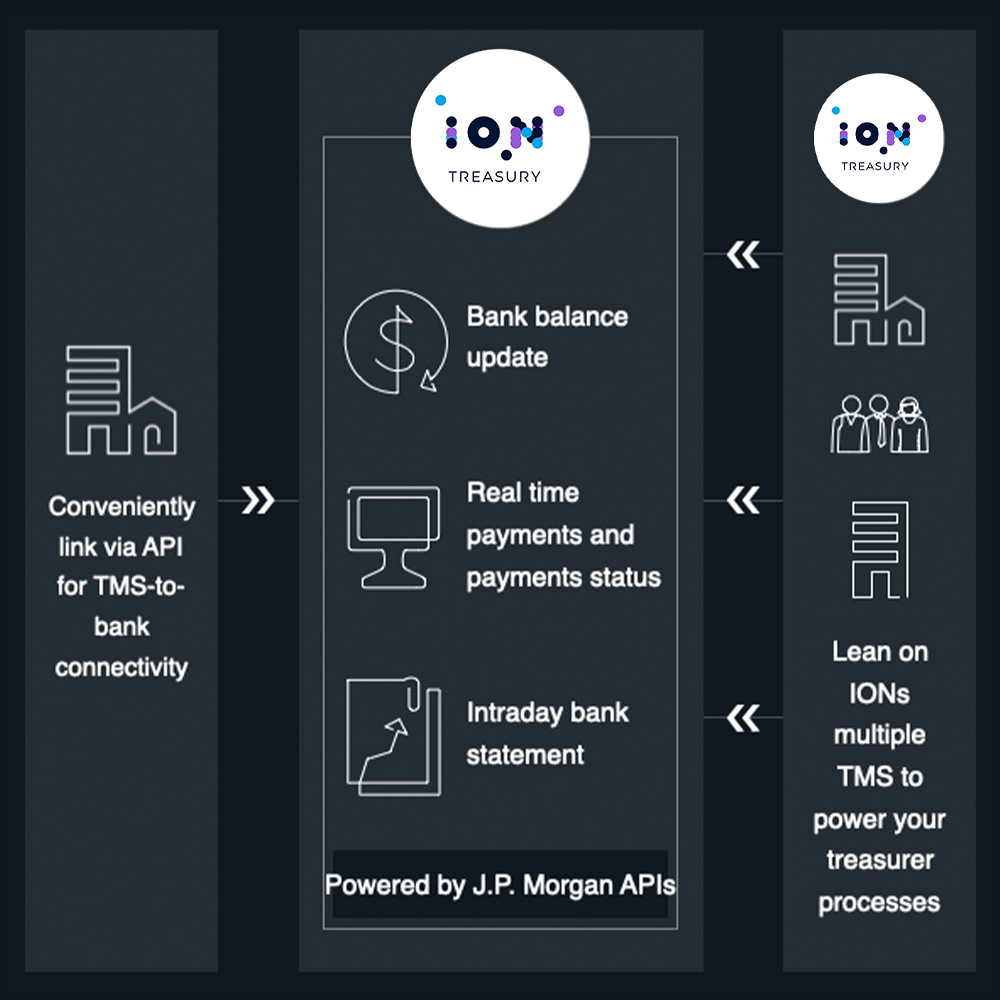

ION Treasury

Partner product overview

ION Bank Connectivity is a cost-effective solution hosted by your trusted TMS partner. It features 24/7 execution and monitoring, providing confidence that your critical banking needs are executed safely and securely. By connecting to your J.P. Morgan accounts through our fast and secure connectivity gateway and API's, ION provides treasurers with current balances and transaction information to effectively manage cash and liquidity without delay. The ION, J.P. Morgan integration leverages advanced security methods including:

- Multi–factor authentication to protect against cyber-threats.

- Data signing to ensure message integrity.

- Encryption to obfuscate message content.

- Seamless integration with your ION TMS.

- Management of global statement and payment message transformation libraries.

- Reporting of bank delivery status updates.

- 24/7 managed support and monitoring of exceptions.

Benefits with J.P. Morgan

With J.P. Morgan as a key ION integration partner, you will be implementing a bank connectivity solution with two world-class treasury service providers with decades of global experience.

Together, ION and J.P. Morgan will provide timely payment execution and bank balance reporting that leverages banking APIs for intra-day updates. Additional benefits include:

- Electronic bank account management to automate bank relationship operations and manage bank fee analysis.

- Simplified management of mission-critical services through one solution provider.

- State-of-the-art technology focused on the highest security standards and controls.

- Bank relationship on-boarding assistance for faster implementations.

- Scalability for high volume payment factory.

- Access to the SWIFT network without a significant investment in an in-house gateway.

Partner bio

ION’s Treasury portfolio has unique treasury and risk management solutions to help you manage liquidity at any scale, in any country, while mitigating financial, regulatory, and operational risks.